How to Check Income Tax Refund Status Online for FY 2025-26

An income tax refund is basically the money you get back as a taxpayer from the government in case you have paid more tax than the actual liability in a financial year. This happens when you pay your taxes in advance through TDS (Tax Deducted at Source), advance tax, or self-assessment tax, but the final tax liability turns out to be lower.

The difference usually arises due to deductions, exemptions, or tax credits claimed while filing the Income Tax Return (ITR). Once the ITR is filed, the Income Tax Department reviews it and calculates the final tax payable. If the tax paid is higher than what is owed, the extra amount is refunded to the taxpayer.

Read on to know more about different types of refund status, how to check refund status, how to request a refund reissue and other related details.

How to Check Your ITR Refund Status for AY 2026‑27?

It is important to know the PAN and assessment year in order to check the status of the refund. There are the three different ways by which you can check the income tax refund status online 2024-25 are mentioned below:

The two ways to check refund Status are:

- The Income Tax E-filing Portal

- The TIN NSDL Portal

- Through TRACES

How to Check Income Tax Refund Status via the Income Tax Portal?

Follow the given steps to get refund status via E-Filing Website:

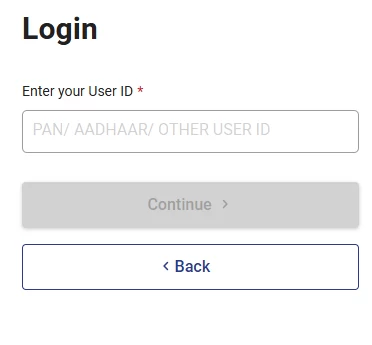

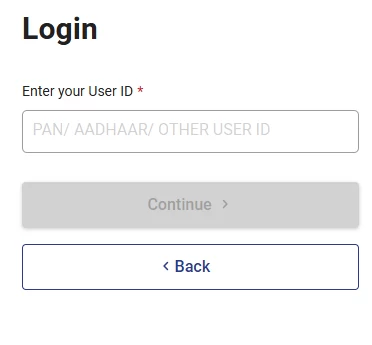

Step 1: Visit the official e-Filing portal.

Step 2: Enter your User ID (PAN/Aadhaar number).

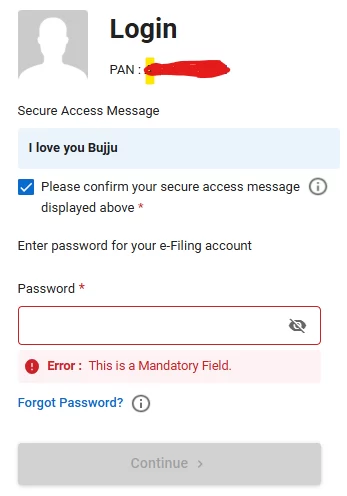

Step 3: Enter your password on the next screen and log in.

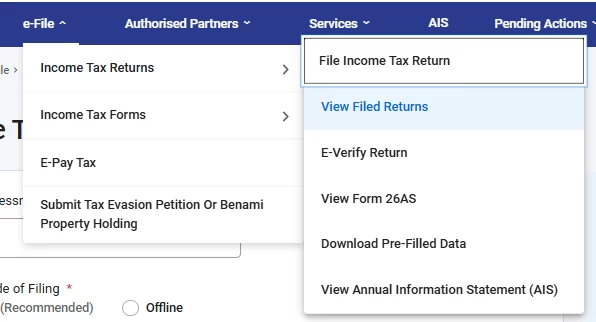

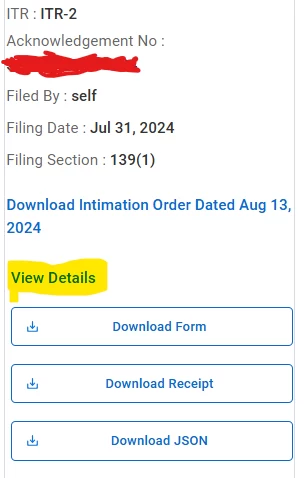

Step 4: Click on the ‘e-File’ tab, select ‘Income Tax Returns’, and then choose ‘View Filed Returns’.

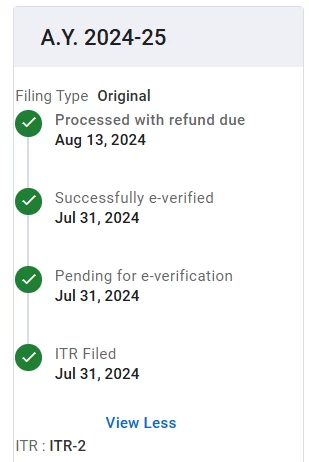

Step 5: The status of your income tax returns will be displayed.

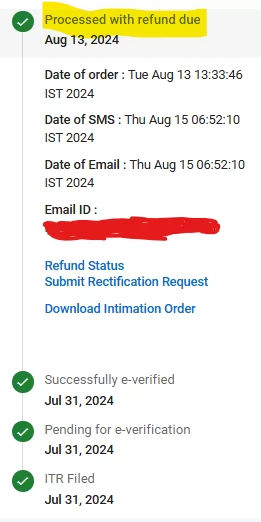

Step 6: Click on 'view details' to check the status of your income tax refund.

Step 7: You can now view the complete refund process, including the due date and other relevant details, as shown in the image below.

How to Track Income Tax Refund on TIN‑NSDL Website

Follow the given steps to get refund status via TIN NSDL Website:

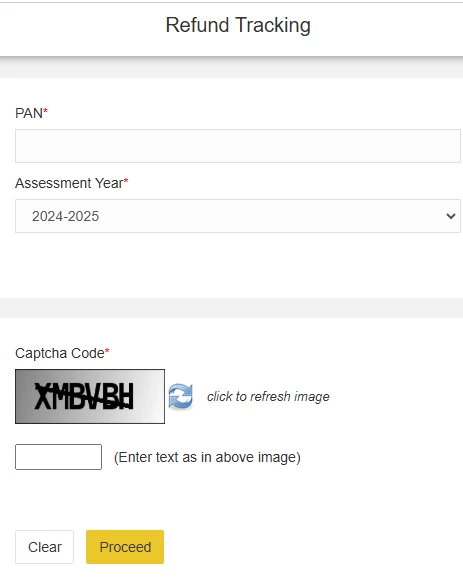

Step 1: Visit the official NSDL website.

Step 2: Enter your PAN, select the appropriate Assessment Year, and enter the Captcha code.

Step 3: Click on ‘Proceed’ to view the status of your refund.

How to Track Income Tax Refund via TRACES

Step 1: Log in to the Income Tax e-Filing portal.

Step 2: Go to the 'e-File' tab and select ‘Income Tax Returns’ > ‘View Form 26AS’.

Step 3: You’ll be redirected to the TRACES website. Click on ‘Confirm’ to proceed.

Step 4: On the TRACES page, choose the Assessment Year and select ‘HTML’ or ‘PDF’ format.

Step 5: Click on ‘View/Download’ to access your Form 26AS, which shows all TDS deposited, advance tax paid, and refund status (if applicable).

What are the different Income Tax Refund Status Types?

Status | Meaning |

Not Determined | Your return is submitted, but the refund amount hasn’t been calculated yet. |

No e-Filing for this Assessment Year | You haven’t filed your return online for this year, or you filed it manually. |

Refund Paid | Your refund has been successfully credited to your bank account. |

ITR Processed & Sent to Refund Banker | Your return is processed, and the refund is on its way to your bank. |

Refund Unpaid | Refund couldn’t be delivered—there may be an issue with your bank details. |

No Demand No Refund | Everything is correct—no extra tax to pay, and no refund due. |

Demand Determined | The tax department says you owe more tax, so no refund will be given. |

Contact Jurisdictional Assessing Officer | The tax department needs some clarification—please contact your local officer. |

Rectification Processed, Refund Sent | Your correction was accepted, and your refund is being sent. |

Rectification Processed, No Demand No Refund | Your correction was accepted, but there’s no extra tax or refund. |

Rectification Processed, Demand Determined | Your correction was accepted, but you still owe tax. Pay within 30 days. |

Refund is credited to your bank, please contact your bank | In this case, the refund is already processed and credited to your bank. If you have not received your refund, then you need to contact State Bank of India Address: Survey No.21 Opposite: Hyderabad Central University, Main Gate, Gachibowli, Hyderabad -500019 Email: itro@sbi.co.in Contact Number: 1800 425 9760 |

Rectification Filed | For this status the rectification is filed, and it is under process |

Refund Re-issue Failure | As per this status, the refund re-issue was not successful due to some incorrect details |

Another Return Filed | You have filed another return, and you need to check your refund reissue status using your latest acknowledgement number |

ITR Accepted | Your ITR has been successfully received at CPC Bangalore, but not processed |

ITR V Rejected | In such a case, your return has been treated as a defective return |

Invalid Original Return, File Revised Return | This status shows that your return has been treated as ‘Invalid’ by the tax department, and you will have to file another return |

Processed with Demand Due | In this case, you tax liability is determined by the tax department and tax payable has been determined up on it |

How to Request a Tax Refund Reissue?

If your income tax refund has failed or is delayed, you can request for it to be reissued by following these steps:

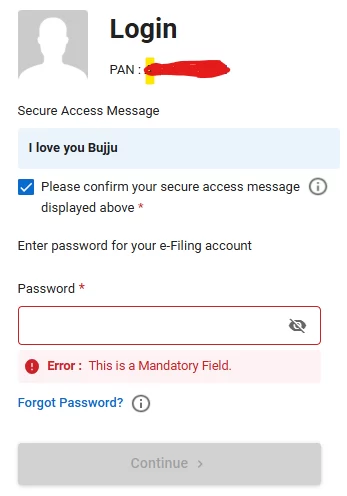

Step 1: You need to visit the official income tax portal and log in using your ID and password.

Step 2: Enter your User ID, PAN, or Aadhaar Number.

Step 3: Enter your password to log in.

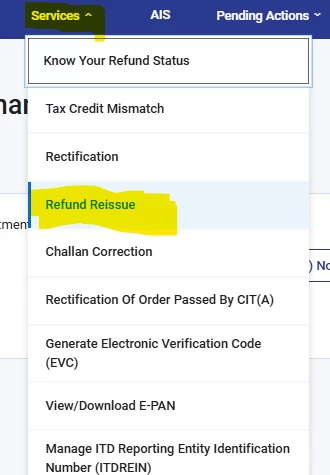

Step 4: On the dashboard, you need to select ‘Services’ tab and then click on ‘Refund Reissue’.

Step 5: You will be redirected to the window with ‘Refund Reissue’ option.

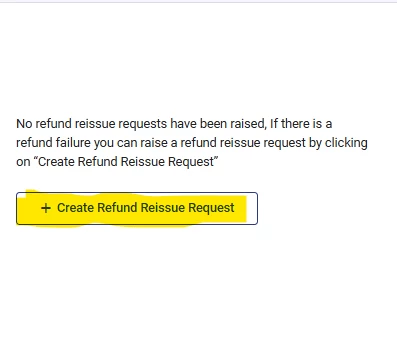

Step 6: Once you click on the option, you will be redirected to a page where you can submit a ‘Refund Reissue’ request.

Step 7: You will have to choose the bank account where you want to get the refund and click on ‘Proceed’ to complete the verification process.

Step 8: You will be required to authenticate your refund reissue request using Aadhaar OTP or EVC code.

Step 9: Click on ‘Submit’ button.

Modes of Receiving Income Tax Refund

The payment of your income tax refund can be made in two ways:

How is Your Income Tax Refund Directly Credited?

Income tax refunds can be credited directly to your bank account via NECS (National Electronic Clearing System) or RTGS (Real-Time Gross Settlement). To ensure timely credit of the refund, make sure to provide accurate bank details, including your communication address, bank account number, and the IFSC code of your bank branch. Providing correct information helps ensure smooth and efficient refund processing.

Receiving Income Tax Refund via Cheque

If your bank account details are incorrect or incomplete, the refund will be sent to you through a cheque delivered to your registered address.

Reasons for ITR Refund Failure

Here are some common reasons why your income tax refund may not be credited:

- The bank account has not been pre-validated on the e-Filing portal.

- The bank account is closed.

- The account is neither a savings account nor a current account.

- KYC (Know Your Customer) details have not been provided.

- Incorrect bank details have been entered.

- PAN and Aadhaar are not linked to the bank account, or the account has become inoperative.

Reasons behind Delay of Income Tax Refund

The below-listed are some of the reasons behind delay of Income Tax Refund:

- There can be errors in your Income Tax Return, like incorrect bank information, missing details, wrong contact number, etc. These errors can cause delay in reissue of refund.

- At times, the tax department takes extra time to verify tax related details and the identity of the taxpayer, which can cause delay in processing refund.

- If you owe taxes from earlier years, the refund may be adjusted against those dues, leading to a reduced or delayed refund.

- At times refund reissue is delayed due to updates in tax laws or procedures. This can lead to a delayed or reduced refund.

- Another possible cause of refund delay is errors in refund calculation, incorrect deductions, or missing documents.

- Some returns are also flagged for manual review due to complex cases, large refund amounts, or random scrutiny. This can delay refund reissue.

Interest paid by the Income Tax Department on Delayed Refunds

The Income Tax Department pays a simple interest of 0.5% per month (or part of a month) for delayed refunds:

- In case the refund is due to TDS/TCS/Advance Tax, interest is calculated from 1st April of the assessment year until the refund date, provided the return was filed on or before the due date.

- In case the return was filed late, interest is calculated from the date of filing till the refund date.

- No interest is paid if the refund amount is less than 10% of the total tax liability determined.

FAQs on Income Tax Refund Status

- What should I do if my refund is marked as “Unpaid”?

If your refund status shows “Unpaid,” verify your bank details in the e-Filing portal and request a refund reissue under the “Services” section.

- Can I receive the income tax refund in a different bank account than the one used earlier?

Yes, you can update your bank account by adding and pre-validating a new account in your e-Filing profile before raising a refund reissue request.

- If my income tax refund has been delayed, will I receive any compensation?

Yes, if your refund is delayed, you are entitled to receive interest at 0.5% per month (or part of a month) on the refund amount, as per Section 244A of the Income Tax Act.

- When will I become eligible for an income tax refund?

You are eligible for an income tax refund if you have paid more tax than your actual tax liability. The refund is calculated while filing your ITR (Income Tax Return).

- What is the time limit for claiming an income tax refund?

You can claim an income tax refund after filing your ITR. The deadline for filing returns and claiming a refund for any Assessment Year (AY) is 31st December of the relevant financial year.

- How long does it take for the refund to reflect in my account?

It generally takes 30 to 45 days after processing for the refund to be credited to your bank account.

- Can I check my income tax refund status online?

Yes, you can check your refund status online through the Income Tax e-Filing portal or the NSDL TIN website.

- What is the difference between an income tax return and an income tax refund?

An income tax return (ITR) is a form where you declare your income and tax details. An income tax refund is the amount returned to you if you have paid excess tax.

- Whom should I contact for queries related to my income tax refund?

You can contact the Income Tax Helpdesk at 1800-180-1961 or email refunds@incometax.gov.in.

- Will I have to pay tax on the refund amount?

No, the refund itself is not taxable, as it's a return of excess tax paid. However, any interest received on the refund is taxable and must be reported in your ITR.

- Do I have to file an income tax return to get a refund?

Yes, you must file your ITR to claim any refund for excess tax paid during the financial year.

- Is there a limit to the number of times I can file revised returns?

Yes, you can file revised returns multiple times, but only within the time limit, currently up to 31st December of the relevant assessment year, unless extended by the government.

- Is it possible to get an Income Tax refund credited to another account?

Yes, it is possible to get an Income Tax refund credited to another account in case you filed a revised return, or refund has already been initiated but failed to be credited in your bank account.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.