All about PAN Card Cancellation

Having multiple PAN Cards can lead an individual to pay a hefty amount as a fine as well and can also result in him/her being jailed.

With the government making it mandatory to link Aadhaar with a PAN Card, individuals and business entities who have more than one PAN Card in their name have been compelled to cancel their additional PAN Cards.

As a result of this decision of the government, those who have more than one PAN Card in their name are looking at ways of getting rid of duplicate PANs and additional cards. So, what is the process that an individual needs to follow if he/she intend to cancel the duplicate/additional PAN Cards in their name? Read on to find out more about the topic.

Reasons for Cancellation of a PAN Card

here can be different reasons behind cancelling PAN Cards. Some of the reasons that lead the Income Tax Department to cancel PAN Cards are:

- Fake PAN Cards: Individuals often obtain fake PAN Cards by using fake documentation. This is done to evade taxes. These cards are also deactivated by the Income Tax Department.

- Multiple PAN Cards: Upon losing their existing PAN Cards, many individuals apply for a new one instead of getting a reprint of their existing card. In such cases, the Income Tax Department deactivates any extra PAN Card allocated to the individual.

- PAN Card of the Deceased: Upon receiving a formal application from the deceased's next of kin, the Income Tax Department deactivates the PAN of the deceased cardholder. The department often requires a copy of the death certificate of the deceased along with the formal application.

- PAN Card for Foreigners: Foreigners who want to discontinue their financial transactions often surrender their PAN Card to the Income Tax Department. This is done to avoid any misuse of their card

PAN Card Cancellation Application Form

Method to Cancel PAN Card?

You can deactivate/cancel your PAN through online and offline processes. Below mentioned are the steps that you should follow to deactivate/cancel your PAN:

1. Online Process to Cancel PAN Card

2. Offline Process to Cancel PAN Card

Online PAN Card Cancellation

Step 1 - Go to the online PAN application page on the NSDL portal.

Step 2 - From the "Application Type" section select the "Changes or Correction in existing PAN Data" option.

Step 3 - Fill out the online PAN change request form and submit it. You will be assigned a token number that you should note down for future reference.

Step 4 - Click on the "Continue with PAN Application Form" button.

Step 5 - Fill out all the details in the form. Remember not to select any ticking boxes (These boxes are selected only if you want to make any changes to your PAN data).

Step 6 - At the end of the form, users are given options between Physical acknowledgment or paperless method. In the paperless method, you have to e-sign with the Aadhar OTP method before applying. For physical acknowledgment, you have to print out your application and mail it to Protean eGov Technologies Limited and mention "Application for PAN Cancellation" on the envelope.

Step 7 - Mention the PAN Card details that you want to surrender and the one that you want to retain at the end of the form.

Step 8 - Submit the application and pay the charges using a debit/credit card or through net banking.

Step 9 - Don't forget to download your application for future reference.

Offline PAN Card Cancellation

Method 1

An assessee should fill out form 49A for making any corrections to his or her PAN Card. Form no.49A should be submitted at any Protean eGov Technologies Limited TIN facilitation center

Method 2

An assessee can also write a letter to the assessing officer of the concerned jurisdiction and list out all pertinent details as listed below:

1. Address of the assessee

2. Name of the assessee

3. Details of additional PAN Card which has to be surrendered

4. Specific details of the PAN Card which has to be retained

5.It is important to note that the assessee needs to have an acknowledgement copy of the letter. The acknowledge letter from the income tax department per se acts as proof that the additional PAN has been cancelled. In other words, the assessee does not have to contact the income tax department again for confirmation on cancellation of his duplicate or additional PAN.

How to Check PAN Card Cancellation Status?

After filling up the form and submitting it for the cancellation of PAN, the next process is to know whether the status of the request. Here, we look how an applicant can check the status of their request. This is can be done by following the below mentioned steps:

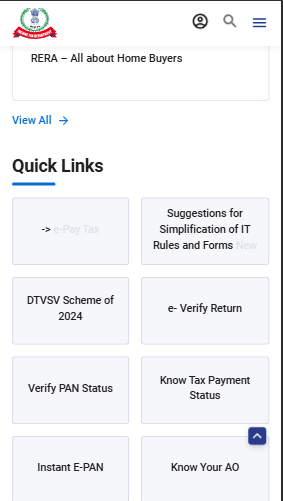

Step 1 - Visit the official website of Income tax e- filling

Step 2 - Select 'Verify PAN Status "under the tab of Quick Links.

Step 3 - Fill in the details asked for like name, date of birth, gender, and mobile number, and click 'Submit'

Step 4 - On doing so, an OTP is sent on the mobile number provided.

Step 5 - Enter the OTP and click 'Validate'

Step 6 - The status of the PAN Card that the applicant has in his/her name is displayed on the next screen.

It needs to be mentioned here if the applicant who wants to know the status of PAN has multiple cards in his/her name than they may be asked to provide additional information.

Articles Related to PAN Card

Faqs on PAN Card Cancellation

- What happens if the Income Tax Department allots two PAN Cards to the same individual by mistake?

In case an assessee has been inadvertently allotted more than one PAN Card by the IT department of India, they can apply for a request to cancel the duplicate card. After satisfactory verification of the application by the Assessing Officer, the additional card would be cancelled.

- How to apply for PAN Cancellation?

If under some unavoidable circumstances an individual has to cancel their PAN Card, they can do it by following either of these two methods:

- Online cancellation - To cancel a PAN Card online, the assessee has to log on to the official website of the Income Tax Department of India and fill in an online form with necessary details by following the instructions mentioned in the form.

- Offline cancellation - An individual can write a letter providing all necessary details to apply for PAN cancellation and submit it to the office of the assessing officer of the concerning jurisdiction.

- What is the payment process of PAN Card cancellation?

If an assessee wants to cancel the PAN in order to apply for a new one, they can do it by filling up a request form that has to be submitted along with a demand draft or cheque of Rs.50 to Rs107 (including gst) in favour of 'Protean eGov Technologies Limited-PAN'. The demand drafts should be payable at Mumbai while applicants can drop their cheques (drawn on any bank) with any HDFC branch across India.

- Does a citizen have to cancel their PAN Card and apply for a new one if they move to different cities within India?

No, PAN Card contains a ten digit alphanumeric number that is valid across the country. If a citizen has to shift his base within India, there is no need for them to cancel their existing PAN Card.

- Can one cancel their existing PAN Card?

There is no way to cancel existing PAN Card. Also, it is strongly advised not to cancel or surrender an existing PAN Card since it serves as a valid identity proof and is mandatory for any financial business and transactions. If, however, one wishes to cancel their existing PAN Card, they have to visit the Assessing Officer of their particular jurisdiction, and submit a letter requesting for the same.

- On what circumstances can one cancel their PAN Card?

- The assessee is moving out of the country permanently.

- The assessee has been mistakenly allotted more than one PAN Card by the Income Tax Department of India.

- The existing PAN Card of an individual contains any errors.

- In the event of death of an assessee, their immediate relatives can apply for cancellation of PAN to the Income Tax Department.

- For any company/ firm/ partnership, one can apply for PAN Card cancellation if they go out of business.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.