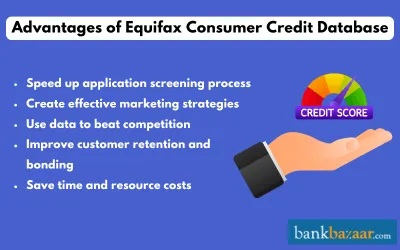

Advantages of Equifax Consumer Credit Database

Given that loans and advances running into thousands of crores are disbursed every year in India, the stakes are high and stakeholders, more often than not, looking to streamline their finances. Equifax aims to provide adequate information to lending institutions, thereby, helping them make more informed decisions.

The consumer credit database compiled by Equifax is of tremendous use to both financial institutions/credit companies and individuals, helping them meet certain financial goals.

Benefits offered by Equifax Consumer Bureau to lenders

With thousands of potential borrowers applying for loans on a daily basis, lenders can find it a huge task to scrutinize applications and weed out the ineligible ones. Utilising the Equifax Consumer Credit Database can, therefore, be beneficial to them in the following ways:

- Faster scrutiny – An Equifax consumer credit database enables financial companies to fast track applications, filtering out the eligible borrowers from those who do not meet their lending parameters. The report also allows them to segregate borrowers based on their location, lifestyle and credit requirements, helping them provide customer-centric services, thereby, improving their overall relationship with borrowers.

- Marketing strategies – Utilizing the vast consumer database can help lenders come up with new marketing strategies based on the information, thereby ensuring that targeted action is taken to expand their customer base. Successful marketing strategies can result in better income generation opportunities, besides providing an avenue for growth.

- Beat competition – With competitors in every field of life, having unique date can be a boon. Companies can rely on this data to stave off competition, helping them reach the top of the mountain, provided they use this information judiciously.

- Customer retention – The data provided by Equifax can be used by companies to increase consumer retention and target new customers, thereby, build a strong user base. The information can also help them connect with consumers on a personal level, strengthening their bond.

- Easy maintenance – The data can save lending agencies time and money, helping them use their resources efficiently

The benefits of Equifax’s consumer credit database are manifold provided the information is used effectively by companies given that the onus is on them vis-a-vis utilization of available data on borrowers.

Benefits offered by Equifax Consumer Bureau to borrowers

Borrowers in need of financial assistance are also benefited by being part of Equifax Consumer database in the following ways.

- Credit feasibility – Consumers can figure out the credit amount they can avail from lenders based on the information, thereby, helping them plan their finances accordingly.

- Simplified process – The information available can make it simpler for individuals to avail loans, as lenders can use the data to fast track applications of eligible candidates.

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.